A Premier Real Estate Private Equity Fund in India: Thought Leadership, Innovation & Scale

Read More

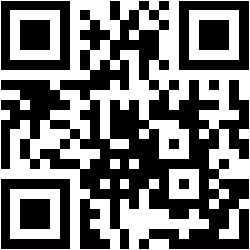

Be a part of the HDFC H@ART Ecosystem by scanning

the QR Code or say "Hi" to 8928375957 on Whatsapp

Path to a million homes In pursuit of more than a billion smiles in India

Read More

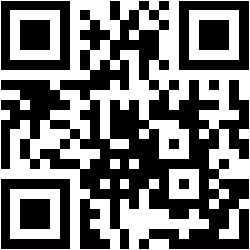

Be a part of the HDFC H@ART Ecosystem by scanning

the QR Code or say "Hi" to 8928375957 on Whatsapp

Introducing Technology in Affordable Housing

Read More

Be a part of the HDFC H@ART Ecosystem by scanning

the QR Code or say "Hi" to 8928375957 on Whatsapp

Sustainable & Responsible Investing Committed to Inclusive Growth

Read More

Be a part of the HDFC H@ART Ecosystem by scanning

the QR Code or say "Hi" to 8928375957 on Whatsapp